American Airlines’ AAdvantage Business program lets companies earn miles on employee travel while those employees earn bonus Loyalty Points toward elite status, on top of what they’d earn as regular AAdvantage members. It’s essentially double-dipping, and it’s free.

The program launched in late 2023, replacing the old Business Extra program. Two years in, thousands of businesses have joined and American has added meaningful upgrades (including a calendar-year qualification reset and a premium Business Select tier) that make it more practical for small and mid-sized companies heading into 2026.

Here’s the full breakdown of how AAdvantage Business works, what changed for 2026, and how to get the most out of it.

Key Takeaways

- What it is: A free loyalty program for businesses that earns company miles + bonus Loyalty Points for employees on eligible AA travel.

- Earning: Companies earn 1 mile per $1 spent. Registered travelers earn 1 additional Loyalty Point per $1 spent (on top of their personal AAdvantage earnings).

- 2026 Changes: Calendar-year qualification replaces rolling 12-month window. Spend from nonregistered travelers now counts toward redemption thresholds.

- Business Select Tier: Companies spending $250K+ per year unlock up to 4% flight savings, Preferred Group 5 boarding, and immediate mile access.

- Eligibility: Available in the U.S., Canada, Argentina, Brazil, Chile, Colombia, Mexico, and Peru. Requires a tax ID and at least 5 employees (or a Citi AAdvantage Business credit card to bypass minimums).

- Redemption Requirements: 5 unique travelers + $5,000 in spend to unlock mile redemptions, waived entirely with the Citi AAdvantage Business card.

- Credit Card Synergy: The Citi AAdvantage Business Mastercard earns an additional 2 miles per $1 for the company on AA purchases, plus 1 Loyalty Point per $1 for each cardmember.

What Is AAdvantage Business?

AAdvantage Business is American Airlines’ corporate loyalty program, designed primarily for small and medium-sized businesses. It runs alongside the standard AAdvantage frequent flyer program, it doesn’t replace it.

The core value proposition: when employees fly for business, the company earns miles into a central business account, and the traveler earns bonus Loyalty Points that accelerate their path to elite status. Both of these are earned in addition to the miles and Loyalty Points the traveler already earns through their personal AAdvantage membership.

The program also includes a suite of travel management tools (travel policy settings, trip credit management, expense integrations, and reporting) that give smaller companies capabilities typically reserved for enterprises with dedicated travel departments.

AAdvantage Business replaced the legacy Business Extra program, which earned points on a different currency (4 points per $20 spent). The new program simplified everything into miles and Loyalty Points, aligning it with the broader AAdvantage ecosystem.

How AAdvantage Business Earning Works

This is where the program gets interesting. Every eligible flight generates rewards at three levels: what the traveler earns personally, what the business earns, and what the credit card adds on top.

| Source | Business Earns | Traveler Earns |

|---|---|---|

| AAdvantage (personal) | — | 5 miles + 1 Loyalty Point per $1 spent on eligible flights* |

| AAdvantage Business | 1 mile per $1 spent | 1 additional Loyalty Point per $1 spent** |

| Citi AAdvantage Business Mastercard | 2 miles per $1 on eligible AA purchases | 1 Loyalty Point per $1 for each cardmember |

Notes:

- (*) Base rate. Elite members earn additional miles based on status tier. Does not include taxes and fees. Basic Economy fares purchased after December 17, 2025, earn zero miles and zero Loyalty Points.

- (**) Travelers must register with the company’s AAdvantage Business account to earn the additional Loyalty Points.

Example: A registered traveler books a $1,000 flight on American using the Citi AAdvantage Business card. Here’s what happens:

| Reward | Amount |

|---|---|

| Traveler’s personal AAdvantage miles | 5,000 miles |

| Traveler’s personal Loyalty Points | 5,000 LP |

| Business AAdvantage miles (from program) | 1,000 miles |

| Business AAdvantage miles (from credit card) | 2,000 miles |

| Traveler’s bonus Loyalty Points (from program) | 1,000 LP |

| Traveler’s bonus Loyalty Points (from credit card) | 1,000 LP |

| Traveler total Loyalty Points | 7,000 LP |

| Business total miles | 3,000 miles |

That’s a significant boost for status seekers: the traveler earns 7,000 Loyalty Points on a $1,000 flight instead of 5,000. For Executive Platinum qualification at 200,000 LP, that extra 40% adds up fast.

Basic Economy Earns Nothing

Basic Economy fares purchased after December 17, 2025, no longer earn AAdvantage miles or Loyalty Points. This applies to both personal AAdvantage earnings and AAdvantage Business program earnings. Book Main Cabin or above to earn toward the business account and status.

What Changed in 2026

American introduced two meaningful updates to AAdvantage Business effective January 1, 2026:

Calendar-Year Qualification Reset

Previously, companies qualified for redemption benefits on a rolling 12-month basis, which made tracking confusing. Starting in 2026, qualification is tied to the calendar year. Once your company hits the redemption thresholds within a calendar year, benefits remain active through the end of that year and the entire following year, up to 24 months of access.

Companies that qualified based on 2025 activity retain their redemption benefits through the end of 2026. To maintain benefits into 2027, you’ll need to re-qualify during 2026.

Nonregistered Traveler Spend Now Counts

Previously, only travel by registered employees counted toward unlocking redemption benefits. Starting in 2026, every dollar spent on eligible employee travel counts, including spend for travelers who aren’t registered with the company’s AAdvantage Business account.

This is a practical improvement. Companies with frequent contractors, new hires who haven’t registered yet, or employees who simply haven’t set up their accounts now get credit for that spending toward the company’s redemption thresholds.

Pro Tip

If your business is close to the $5,000 spending threshold for redemption benefits, the nonregistered traveler change could push you over without any additional effort. Review your total AA spend for the year, not just registered traveler bookings.

AAdvantage Business Select Tier

For companies with significant travel spend, American launched the AAdvantage Business Select tier in mid-2025. It rewards businesses that spend $250,000 or more on eligible travel in a calendar year.

| Benefit | Details |

|---|---|

| Flight savings | Up to 4% discount on eligible fares |

| Preferred boarding | Group 5 for all registered business travelers |

| Immediate mile access | Minimum program requirements waived for redemptions |

| Qualification | Automatic once $250K threshold is met |

| Notification | Welcome email within 24–48 hours of qualifying |

Flight Savings Breakdown

The discount rates vary by cabin and destination:

| Cabin | Booked in | To/From CLT, DCA, DFW, MIA, PHL | To/From All Other Destinations |

|---|---|---|---|

| First / Business | F, A, J, C, D, R, I | 4% | 4% |

| Premium Economy / Main Cabin | Y, B, H, K, M, L, V, G, S, W, P, E | 2% | 4% |

Discounts apply to American marketed fares from eligible points of sale. Excludes Basic Economy and non-discountable fares. On domestic flights, discounts are for flights marketed and operated by American. On international flights, discounts cover flights marketed by American and operated by American and certain partners, including Joint Business Partners.

Instant Mile Access

Business Select also grants immediate access to company miles, meaning the standard minimum requirements (5 travelers, $5,000 spend) are waived. Once qualified, you can redeem or transfer miles right away.

Eligibility and How to Register

Requirements

To join AAdvantage Business, your company needs:

| Requirement | Details |

|---|---|

| Location | U.S. or select international markets |

| Tax ID | Valid government-issued tax ID (U.S.) or business number (Canada) |

| Employees | At least 5 employees |

| AAdvantage accounts | All travelers and travel managers need AAdvantage accounts |

| Cost | Free |

Citi Card Bypass

If your business doesn’t meet the 5-employee minimum or the $5,000 spend threshold for mile redemptions, holding the Citi AAdvantage Business World Elite Mastercard waives both requirements entirely. The card itself acts as a qualifying credential, you don’t even need to use it for purchases; just having it unlocks full program access.

Available Countries

- United States

- Canada

- Argentina

- Brazil

- Chile

- Colombia

- Mexico

- Peru

How to Register

- Go to aa.com/aadvantage-business and select Register.

- Enter your company details and government-issued tax ID.

- Add employees as registered travelers (each needs an AAdvantage account).

- Start earning on eligible business travel immediately.

Travel agencies, wholesalers, consolidators, and resellers of travel are not eligible. The program is for businesses booking travel for their own employees, not for booking on behalf of others.

Redemption Requirements

To actually use the miles your company earns, you need to meet minimum thresholds:

| Requirement | Standard | With Citi Business Card |

|---|---|---|

| Unique travelers | 5+ | Waived |

| Annual spend | $5,000+ | Waived |

| Business Select tier | Waived automatically | N/A |

Once qualified, companies can redeem miles for flights, transfer miles to employee AAdvantage accounts, or use them to offset business travel expenses.

Travel Management Tools

AAdvantage Business isn’t just a rewards program, it includes a management portal with tools that are genuinely useful for companies without a dedicated travel department:

| Feature | Description |

|---|---|

| Trip credit management | Reassign and manage trip credits across travelers |

| Travel policy settings | Set and enforce customizable travel policies |

| Corporate card payments | Manage corporate credit card payments for bookings |

| Expense integrations | Direct integrations with Expensify, Emburse, and Ramp |

| Reporting | Track spending, traveler activity, and mile earnings |

| Dedicated service desk | AAdvantage Business-specific support line |

These features were added progressively since the 2023 launch. The expense integrations with Expensify, Emburse, and Ramp are particularly valuable for small businesses that already use these platforms, no manual reconciliation needed.

Travelers can also switch between personal and business profiles on aa.com and the American Airlines app, making it straightforward to manage mixed business and personal travel.

Citi AAdvantage Business Credit Card

The Citi AAdvantage Business World Elite Mastercard is tightly integrated with the program. Here’s why it matters:

| Feature | Details |

|---|---|

| Welcome bonus | 65,000 miles after $4,000 spend in 4 months |

| AA purchases | 2X miles per $1 on eligible American Airlines purchases |

| Bonus categories | 2X miles at telecom, cable/satellite, car rental, gas stations |

| All other purchases | 1X miles per $1 |

| Loyalty Points | 1 LP per $1 for each cardmember (primary + employees) |

| First checked bag | Free on domestic AA itineraries (primary cardmember) |

| Preferred boarding | Yes (primary cardmember) |

| Companion certificate | After $30,000 spend in card year + renewal |

| Annual fee | $99 (waived first 12 months) |

2026 Loyalty Point Matching Promo

A promotion that’s been running since 2024 has been extended through December 31, 2026: select primary Citi AAdvantage Business cardholders earn 1 Loyalty Point for every 1 Loyalty Point earned by any authorized users on eligible card purchases. This effectively doubles the LP earning potential across employee cards, a significant accelerator for status.

Why the Card Matters

The credit card’s biggest hidden value isn’t the miles, it’s waiving the redemption minimums. Without the card, your business needs 5 unique travelers and $5,000 in spend before you can touch any of the miles you’ve earned. With it, there’s no minimum at all.

AAdvantage Business vs. Delta vs. United

American isn’t the only airline with a small business loyalty program. Here’s how AAdvantage Business stacks up against Delta’s SkyMiles for Business and United’s PerksPlus/United for Business in 2026:

| Feature | AAdvantage Business | Delta SkyMiles for Business | United PerksPlus |

|---|---|---|---|

| Program currency | AAdvantage miles | SkyMiles | PerksPlus points (convert to MileagePlus miles at 2:1) |

| Company earning rate | 1 mile per $1 | 1–10 miles per $1 (varies by fare/hub) | Points on eligible spend |

| Bonus LP/status credits for travelers | ✅ Yes (1 LP per $1) | ❌ No (separate Business Traveler program for non-mile perks) | ❌ No |

| Premium tier | Business Select ($250K) | Elite tier ($300K) | Tiered by spend |

| Premium tier savings | Up to 4% on fares | Varies | Varies |

| Travel management tools | ✅ Full portal | ✅ Basic | ✅ United for Business |

| Expense integrations | Expensify, Emburse, Ramp | Limited | Limited |

| Minimum to redeem | 5 travelers + $5K (waived with Citi card) | 5 travelers + $5K (Plus tier) | $5K annual spend |

| Free to join | ✅ Yes | ✅ Yes | ✅ Yes |

| Status acceleration for travelers | ✅ Yes | ❌ No | ❌ No |

The standout advantage of AAdvantage Business over Delta and United: travelers earn bonus Loyalty Points that count toward personal elite status. Neither SkyMiles for Business nor PerksPlus offer anything equivalent. For companies where employees care about their own status, this is a meaningful differentiator.

Delta’s earning rates can be higher per dollar on certain routes and fare classes, but the miles go to the company only, individual travelers don’t get a status boost from the business program. United’s PerksPlus uses a separate points currency that converts to MileagePlus miles at a poor 2:1 ratio.

AAdvantage Pass: An Alternative for Larger Companies

American also offers the AAdvantage Pass package, which is separate from AAdvantage Business. It lets companies purchase a bundle that includes assigning AAdvantage elite status and Loyalty Points to specific travelers, while the company receives miles.

This is aimed at companies that want to grant status to key travelers rather than have them earn it organically. It’s a different use case, think executive perks rather than broad employee rewards.

How to Maximize Business Miles with AwardFares

Your company’s AAdvantage Business miles can be used to book award flights, either for future business travel or transferred to employees. Here’s how to get the best value:

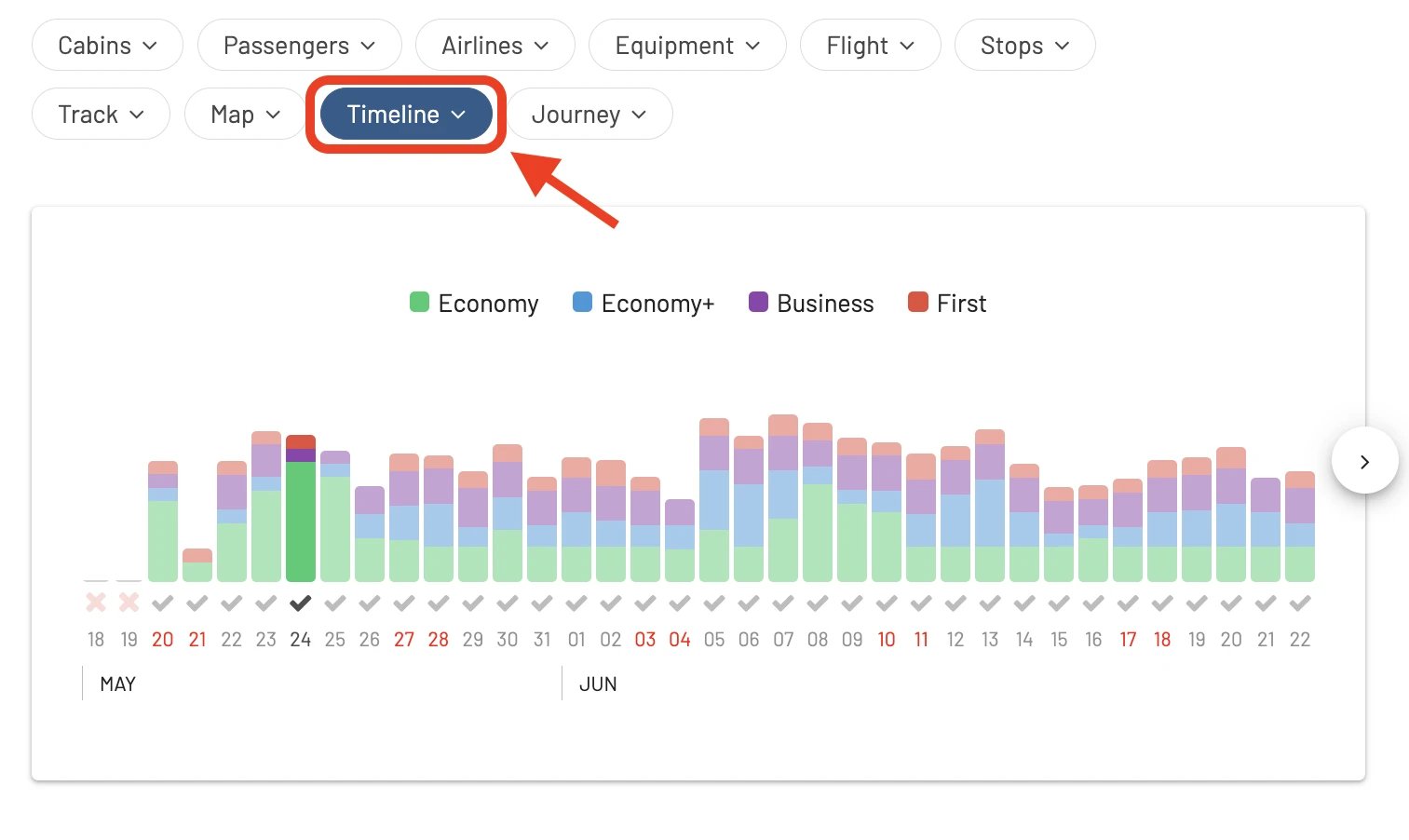

1. Search for Low-Cost Awards

American uses dynamic pricing, so award costs fluctuate significantly. On AwardFares, select AAdvantage as your program and use the Timeline View to see an entire month of prices. You’ll immediately spot the cheapest days without clicking date by date.

2. Set Alerts for Key Business Routes

If your company regularly flies specific routes, say Dallas to London or Miami to São Paulo, award availability can be unpredictable. Set an alert and get notified when seats open up instead of checking manually.

3. Compare Across Programs

AAdvantage miles book flights on all oneworld partners. The same seat might be available at different prices through different programs. Use AwardFares to compare oneworld availability and find where your miles stretch furthest.

4. Transfer Miles to Employees Strategically

If your business has accumulated miles that aren’t being used for company travel, transferring them to employees who book personal award travel can be a high-value perk, especially for premium cabin redemptions where the per-mile value is highest.

Frequently Asked Questions

What is AAdvantage Business?

AAdvantage Business is American Airlines’ free corporate loyalty program for small and medium-sized businesses. Companies earn 1 AAdvantage mile per $1 spent on eligible employee travel, and registered travelers earn bonus Loyalty Points that accelerate their path to AAdvantage elite status.

How is AAdvantage Business different from regular AAdvantage?

Regular AAdvantage is a personal frequent flyer program. AAdvantage Business adds a company layer on top, the business earns miles into a central account, and travelers earn additional Loyalty Points beyond what they’d earn personally. Both programs run simultaneously.

What are the eligibility requirements for AAdvantage Business?

Your business needs a valid tax ID, at least 5 employees, and must be located in the U.S., Canada, or select Latin American countries (Argentina, Brazil, Chile, Colombia, Mexico, Peru). Holding a Citi AAdvantage Business Mastercard waives the employee and spending minimums.

How do I register my business for AAdvantage Business?

Go to aa.com, navigate to the AAdvantage Business section, and select Register. You’ll need your company details and tax ID. Registration is free and takes a few minutes.

What is AAdvantage Business Select?

AAdvantage Business Select is a premium tier for companies spending $250,000 or more on eligible travel per calendar year. It provides up to 4% flight savings, Preferred Group 5 boarding for business travelers, and immediate access to redeem or transfer company miles.

What changed with AAdvantage Business in 2026?

Two key updates: qualification switched from a rolling 12-month window to a calendar-year basis (with benefits lasting up to 24 months), and spend from nonregistered travelers now counts toward the company’s redemption thresholds.

Do travelers earn Loyalty Points through AAdvantage Business?

Yes. Registered travelers earn 1 additional Loyalty Point per $1 spent on eligible flights, on top of the miles and Loyalty Points they earn through their personal AAdvantage account. This accelerates elite status qualification.

How does the Citi AAdvantage Business card work with the program?

The card waives the minimum traveler and spending requirements for mile redemptions. It also earns 2 additional miles per $1 on eligible AA purchases for the company, and each cardmember earns 1 Loyalty Point per $1 on all card purchases toward their personal status.

Can I use company miles for personal travel?

Companies can transfer miles to employee AAdvantage accounts. Once transferred, the employee can use those miles for personal travel, including award flights on American and oneworld partners.

Does Basic Economy earn miles through AAdvantage Business?

No. Basic Economy fares purchased after December 17, 2025, earn zero AAdvantage miles and zero Loyalty Points, both personally and through the AAdvantage Business program. Book Main Cabin or above to earn.

Aeromexico Rewards

Aeromexico Rewards Air Canada Aeroplan

Air Canada Aeroplan

Air France / KLM Flying Blue

Air France / KLM Flying Blue Alaska MileagePlan

Alaska MileagePlan American Airlines AAdvantage

American Airlines AAdvantage Azul Fidelidade

Azul Fidelidade Delta SkyMiles

Delta SkyMiles Etihad Guest

Etihad Guest GOL Smiles

GOL Smiles Jetblue TrueBlue

Jetblue TrueBlue SAS EuroBonus

SAS EuroBonus Turkish Miles&Smiles

Turkish Miles&Smiles United MileagePlus

United MileagePlus Virgin Atlantic Flying Club

Virgin Atlantic Flying Club Virgin Australia Velocity

Virgin Australia Velocity