Stop leaving money on the table. Your business already pays for rent, supplies, and taxes. This guide explores the potential to turn some of those costs into EuroBonus points for your business. With a strategic setup, some businesses explore the potential to earn enough SAS EuroBonus points for multiple Business Class tickets each year, just by paying bills. We’ll also cover the importance of compliance and proper documentation for business travel.

How It Works (Quick Summary)

- Consider Your Card Options: Compare personal and business credit cards for spending. Compare cards here.

- Understand Bill-Paying Services: Services like Bill Kill or Betalo exist. Assess the fees and terms carefully.

- Book Flights Correctly: Always use your company’s free SAS for Work code when booking flights for corporate discounts.

- Compliance is Key: Understand the tax implications; the safest approach is to use points for business travel.

What's in this Guide

Step 1: Set Up Your Business Accounts

Before you start, you need two free accounts.

1. Employee EuroBonus Accounts

EuroBonus accounts are personal. Every employee who travels for work needs their own free account. They will earn points for their flights into this account.

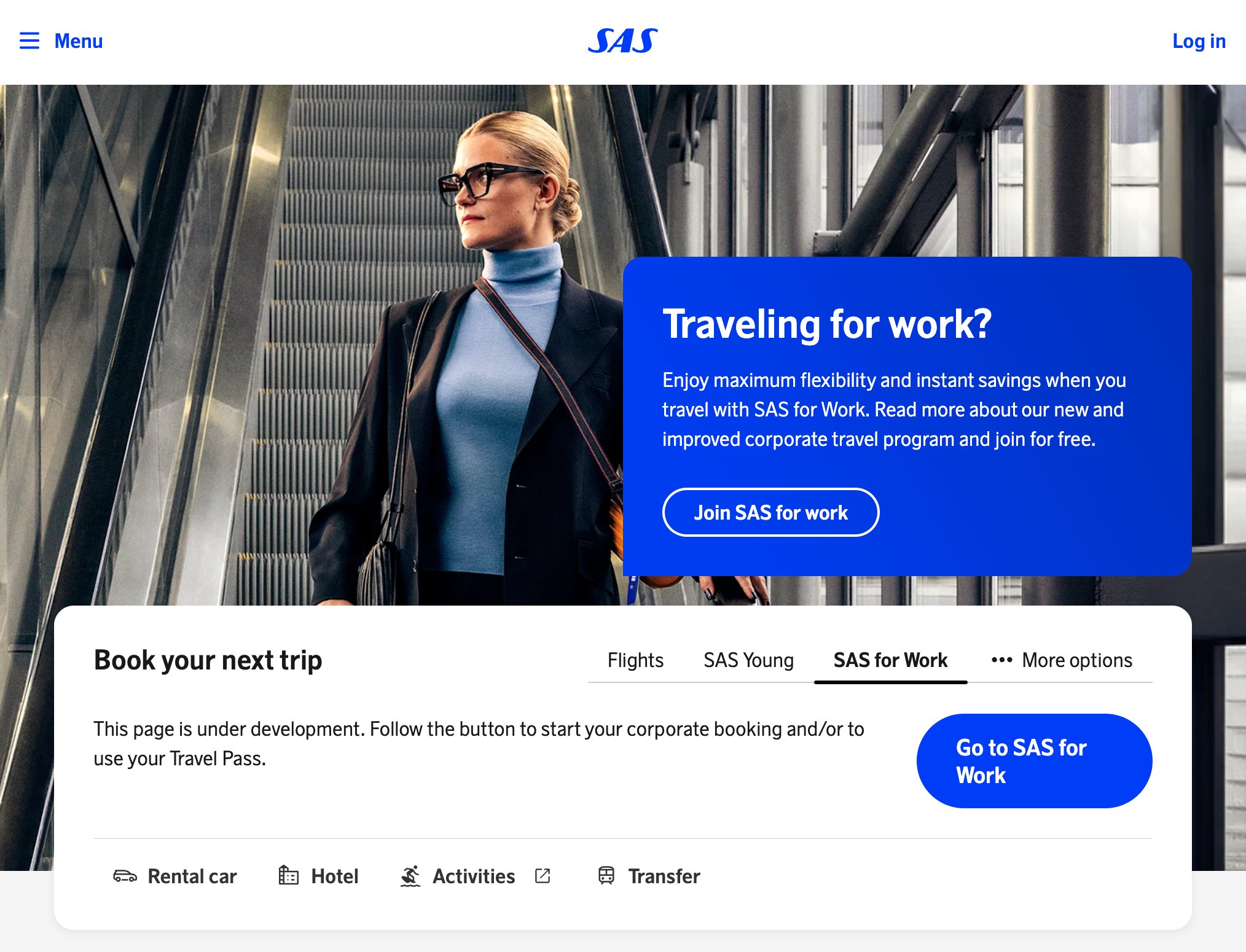

2. Company SAS for Work Account

SAS for Work is SAS’s free corporate program that provides businesses with flight discounts, flexible booking options, and special benefits when employees travel for work. This is your company’s free dashboard with SAS. When you sign up, you get a Corporate Mandatory Prefix (CMP) Code. You must enter this code every time you book a flight to get your company’s benefits.

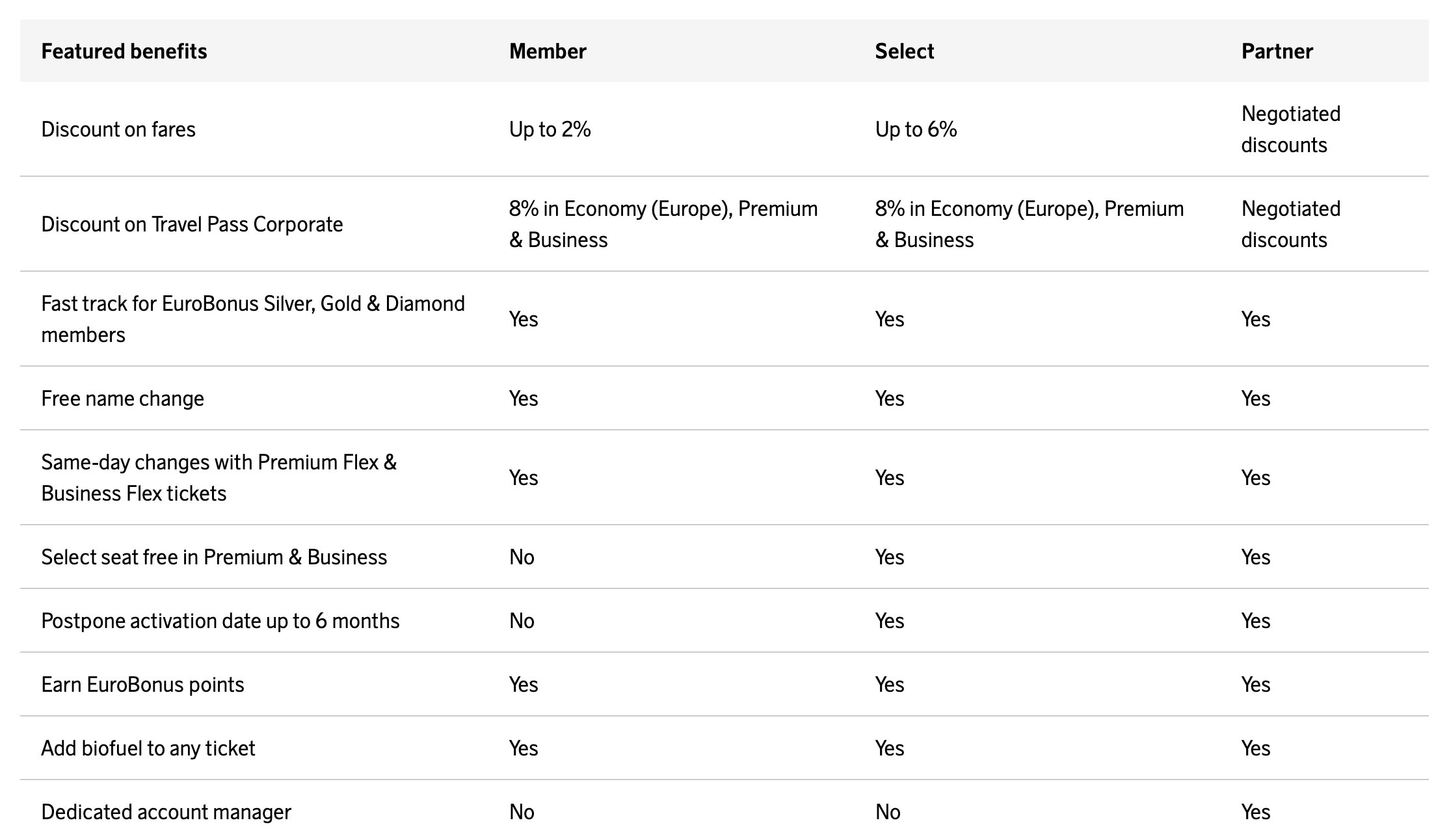

Benefits of SAS for Work:

- Discounts on flights with SAS and partners.

- Free name changes on tickets if an employee can’t travel.

- Faster security for employees with EuroBonus Silver status.

Important

You must use your CMP code to get any benefits. No code means no discount. Make this a rule in your company.

Full terms & conditions of SAS for Work here.

Step 2: Strategies for Earning Points from Business Spending

This is how you will earn the most points, not from flying, but from your everyday business costs.

Use Credit Cards for All Spending

Important Considerations on Business Spending

Using personal credit cards for business expenses and utilizing bill-paying services can involve complex compliance and accounting issues. Company policies, cardholder agreements, and tax rules may restrict these practices. You are responsible for ensuring your company’s spending practices are compliant with all relevant regulations and agreements. Always consult with your financial advisor or accountant before implementing these strategies.

A common way individuals earn points is by using their credit cards for spending.

A Common Approach:

- Consider one or more credit cards based on your company’s spending level.

- Redirect all possible business expenses to these cards.

- Always pay the full balance each month to avoid interest fees.

Choosing the right card is crucial for maximizing points. We have a detailed guide that compares all SAS credit cards for Swedish, Norwegian, and Danish businesses. It’s important to note that SAS and other banks offer dedicated business credit cards (example: American Express Corporate Cards with Membership Rewards). These are specifically designed for company expenses and often provide clearer terms for business use. You should evaluate whether a personal or a business card is the most appropriate and compliant solution for your company.

Pay Large Invoices with Your Card

Some businesses explore using services like Bill Kill (Norway/Sweden), Betalo (Sweden/Norway), and Billo to pay large invoices like rent or taxes with a credit card. Note that some services, like Betalo and Bill Kill, even offer specific business plans intended for this purpose. However, you must always check the terms of service for these platforms and your credit card agreement to ensure you are not violating any rules.

How it works:

- You pay the service with your credit card.

- The service pays your bill via bank transfer.

- You earn all the points from that large payment.

| Service | Where It Works | Best For | Typical Fee |

|---|---|---|---|

| Bill Kill | Sweden, Norway | Large invoices like rent | ~3.0% |

| Betalo | Sweden, Norway | Flexible payments, bank transfers | ~3.4% |

| Billo | Sweden | Lower fees with Visa/Mastercard | ~1.99% |

When to Use Bill Services

This approach is generally only financially viable for expensive flights, like Business Class. Don’t do this for economy flights. At ~3% fee and 20 pts/100 kr, you’re ‘buying’ points at ~1.3 kr per 1,000. If you redeem at ≥0.9–1.2 kr/pt effective value on Business Class, arbitrage is positive; for Economy it’s not.

See How Much You Can Earn

Calculate how many points your business could earn from paying invoices with a card.

Business Points Calculator

See how many points you can earn from paying invoices with a credit card.

Concrete Example: Stockholm Tech Startup

Company Profile: Tech Startup in Stockholm, 15 employees

Monthly Expenses:

- Office Rent: 80,000 SEK

- Supplier Invoices: 40,000 SEK

- Total Monthly: 120,000 SEK

Annual Results:

- Points Earned: 288,000 points

- Equivalent Flights: 2.8 Business Class tickets to NYC

- Total Fees Paid: 43,200 SEK

- Flight Value: ~200,000 SEK

- Net Savings: 156,800 SEK

Step 3: Earn Points from Flights, Partners, and Business Products

Book Flights with Your CMP Code

When employees book flights using the company CMP code:

- Employee gets: Personal EuroBonus points

- Company gets: Corporate discount and benefits

Explore SAS Travel Pass

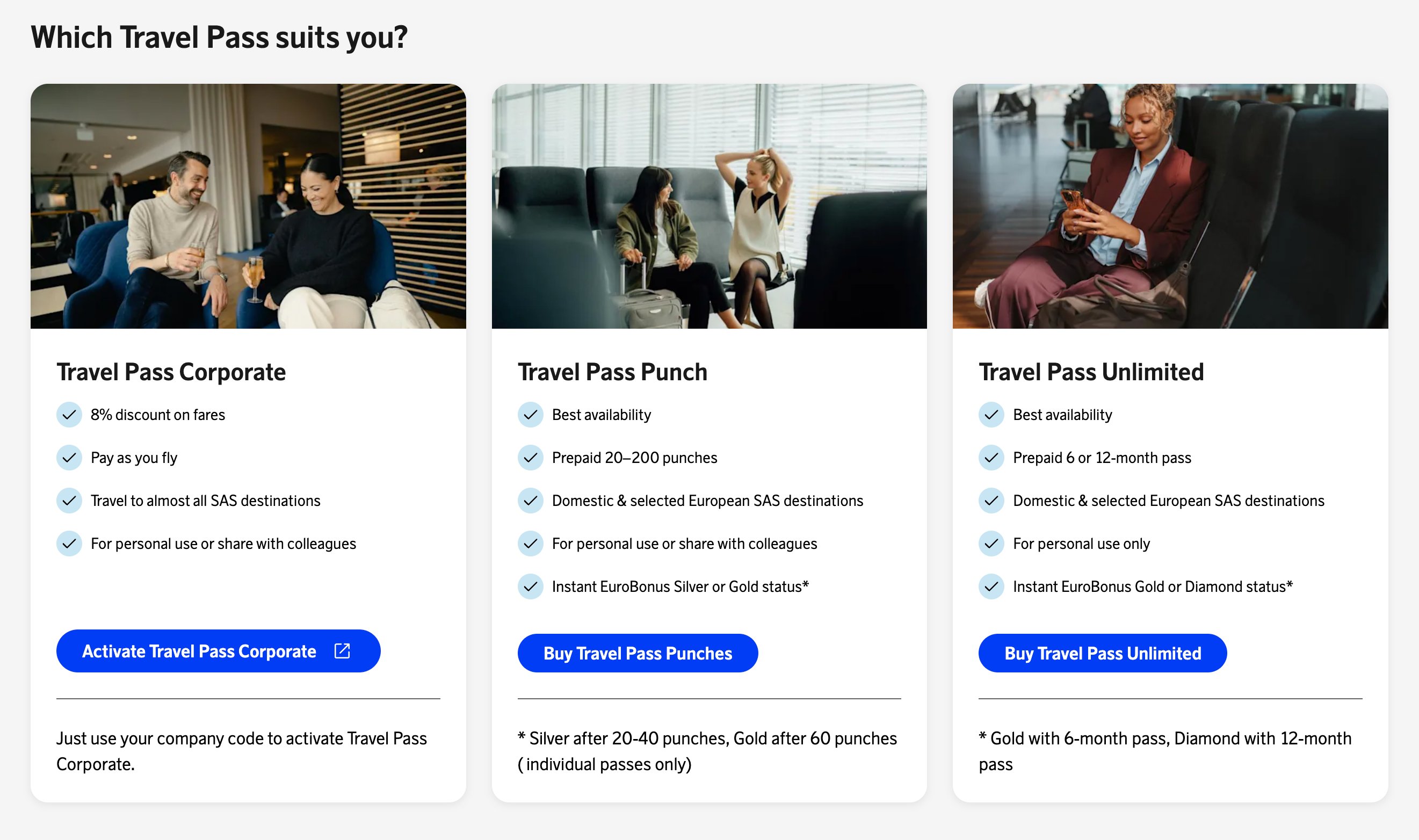

SAS for Work offers a product called Travel Pass, which are pre-purchased flight bundles that can provide significant savings and flexibility. For companies with predictable travel patterns, these can be a valuable tool. Certain Travel Pass punch cards can also grant EuroBonus status instantly, providing additional benefits for your traveling employees.

Use SAS Partners

Earn extra points when your business uses:

- Hotels: Book through “Hotels by SAS”

- Car rentals: Use Hertz and other partners

- Office supplies: Shop through EuroBonus partners

Step 4: Understand the Tax Rules

This is important to avoid problems with tax authorities. The rules are different for Sweden and Norway.

Important Disclaimer

The information in this section is provided for general guidance only and does not constitute tax, legal, or accounting advice. Regulations differ by country and may change. You should consult your accountant or the respective tax authority before making decisions based on EuroBonus points or company spending.

Tax Rules in Sweden (Skatteverket)

According to Swedish tax law, EuroBonus points themselves are not taxed when earned. Taxation only applies when points are used for private benefits.

| Situation | Taxable in Sweden? | Explanation |

|---|---|---|

| Points from personal spending or flights | No | Personal benefit, not work-related |

| Points from business travel used for work flights | No | Business-related use |

| Points from business travel used for private trips | Yes | Might be treated as taxable fringe benefit (förmån) |

What this means for your business:

- Points from credit card spending: Not taxed when earned (considered marketing benefits).

- Points from business flights: Not taxed if used for more business travel.

- Points from business flights used for vacations: In theory, it might be a taxable benefit for the employee, which in practice is hard to assess.

Tax Rules in Norway (Skatteetaten)

Norwegian rules are generally similar but consult with your accountant for specific guidance on how Skatteetaten treats points, based benefits in your situation.

How to Stay Compliant

Option 1: Business Use Only (The Safest Path) To eliminate any potential tax complications, the safest approach is to implement a company policy stating that all points earned from company spending and business travel are to be used exclusively for future business travel. This clearly aligns the benefit with its source and avoids any grey areas.

Option 2: Allow Personal Use If you choose to allow employees to use points for personal trips, you should be aware that this likely creates a taxable benefit. This would require you to:

- Have employees report personal use of business-earned points

- Calculate the cash value of the flight

- Report it as income to the tax authority

- Pay the required taxes

- Keep detailed records

Talk to your accountant to set up the right system for your company.

Frequently Asked Questions

Common Questions

Can my company have one EuroBonus account?

No. EuroBonus accounts are personal. Company points from credit card spending will go to the cardholder’s personal account (like the CEO or finance manager).

Is it worth paying 3% fees to earn points?

It can be, but only if you plan on booking Business Class flights. The value of a Business Class ticket is much higher than the fees you pay. For economy flights, it’s usually not worth it. Plus, only after you’ve confirmed it’s a compliant practice for your business.

What's the best credit card for my business?

It depends on your spending and country. For a potentially more straightforward and compliant approach, also explore dedicated business or corporate cards. See our detailed card comparison here..

What happens if an employee leaves?

Points they earned from their flights are theirs to keep. Points the company earned from credit card spending stay with the company (the cardholder).

Are points from business credit cards taxable?

In Sweden, points earned from credit card spending are generally not taxed when earned, as they’re considered marketing benefits. Taxation only applies when points from business travel are used for private vacations.

Is paying rent or taxes with a credit card allowed in Sweden, Norway, or Denmark?

Yes, but not directly to tax authorities or landlords. Services like Bill Kill, Betalo, and Billo act as intermediaries: you pay them with your credit card, and they transfer the money to the recipient via bank payment. This does not mean it’s the right choice for every business. You must evaluate the fees, terms, and compliance with your own company’s policies.

You earn EuroBonus points on the card charge, minus their processing fee (typically 1.9–3.5 %). This setup is legal and common, but you should:

-

Always document the payment as a legitimate business expense.

-

Verify that the fee is deductible as a financial cost in your accounting.

How many SAS EuroBonus points can my company earn from invoices?

It depends on your monthly spend, card rate, and service fee. Here’s a simple formula and example:

Formula:

(Monthly Spend × 12 × (1 + Fee %)) ÷ 100 × Points per 100 kr = Annual Points

Example:

-

Monthly invoices: 150 000 SEK

-

Points rate: 20 pts per 100 kr

-

Service fee: 3 %

→ Annual Points ≈ 417 600 pts, enough for ~4 Business Class trips to New York.

Use the calculator above to test different values for your company.

More Useful Guides

Find Available Award Flights

Once you have points, you need to find available flights to book them. Use AwardFares to search for SAS award space, see calendar availability, and set up alerts for your routes.

Aeromexico Rewards

Aeromexico Rewards Air Canada Aeroplan

Air Canada Aeroplan

Air France / KLM Flying Blue

Air France / KLM Flying Blue Alaska MileagePlan

Alaska MileagePlan American Airlines AAdvantage

American Airlines AAdvantage Azul Fidelidade

Azul Fidelidade Delta SkyMiles

Delta SkyMiles Etihad Guest

Etihad Guest GOL Smiles

GOL Smiles Jetblue TrueBlue

Jetblue TrueBlue SAS EuroBonus

SAS EuroBonus Turkish Miles&Smiles

Turkish Miles&Smiles United MileagePlus

United MileagePlus Virgin Atlantic Flying Club

Virgin Atlantic Flying Club Virgin Australia Velocity

Virgin Australia Velocity