Choosing the right SAS EuroBonus card can feel needlessly complex. If you’re deciding between the SAS Amex, Mastercard, or Lunar cards in 2025, this guide compares fees, earning rates, and perks across Sweden, Norway, and Denmark, so you can find the best SAS EuroBonus card for your spending habits and travel goals.

In This Guide

- SAS Credit Card Explorer

- How SAS EuroBonus Credit Cards Work

- The Three Card Types: Amex vs. Mastercard vs. Lunar

- Eligibility & How to Apply

- Earning Math & Break-Even ROI

- Which SAS EuroBonus Card Is Best For You? (Sweden, Norway & Denmark Comparison)

- Using Two Cards for Maximum Points

- Advanced Strategy: The Multi-Amex Card Approach

- Pro Moves to Boost Spend (and Earn More Points)

- Common Pitfalls to Avoid

- Frequently Asked Questions

SAS Credit Card Explorer

SAS Amex Premium

Country-by-Country at a Glance

Sweden

- SAS Amex Cards

- SAS Mastercard

- SAS Lunar Debit

Norway

- SAS Amex Cards

- SAS Mastercard

- SAS Lunar Debit

Denmark

- SAS Amex Not Available

- SAS Mastercard

- SAS Lunar Debit

How SAS EuroBonus Credit Cards Work (Earn Points on Every Purchase)

A SAS EuroBonus card turns your spending into travel. The concept is simple:

- You Spend: Use the card for daily purchases like groceries, gas, or online shopping.

- You Earn: For every 100 kr spent, you automatically earn a set number of EuroBonus points.

- You Fly: Use those points to book award flights on SAS and SkyTeam partners such as KLM, Air France, and Delta.

It’s the single fastest way to build your points balance without setting foot on a plane. Premium cards add powerful perks like travel vouchers and elite status shortcuts.

The Three Card Types: Amex vs. Mastercard vs. Lunar

SAS partners with three providers. Each plays a specific role.

| Card | Bonus | Requirements | Eligibility Notes |

|---|---|---|---|

| SAS Amex Premium | 5,000 pts | Half at 7 months, half at 13 months of active card use | New Amex customers only; card must be active when bonuses post |

| SAS Amex Elite | 15,000 pts | Half at 7 months, half at 13 months of active card use | New Amex customers only; card must be active when bonuses post |

| SAS Mastercard World | 3,000 pts | Make 3 purchases within 30 days of approval | Haven’t held a SAS EuroBonus Mastercard in the last 2 years; points post within 3 months; card must be active |

| SAS Mastercard Premium | 10,000 pts | Make 3 purchases within 30 days of approval | Haven’t held a SAS EuroBonus Mastercard Premium in the last 2 years; points post within 3 months; card must be active |

| SAS Lunar Debit | 3,000 pts | Open after 17 Jun 2024, receive card within 14 days, and spend ≥ 15,000 kr within 3 months | New Lunar customers only |

1. SAS American Express: The Points Powerhouse (Sweden & Norway)

Amex offers the highest earning rates and the legendary 2-for-1 voucher, the single most valuable perk in the EuroBonus ecosystem. It’s the specialist card for maximizing points.

| Card | Annual Fee | Points per 100 kr | Status Points | Key Benefit | Best For |

|---|---|---|---|---|---|

SAS Amex Classic

|

Free | 10 | - | European 2-for-1 voucher (at 100k spend) | Light spenders |

SAS Amex Premium

|

approx. 1,620 kr/year | 15 | - | Worldwide 2-for-1 voucher (at 150k spend) | Most strategic earners |

SAS Amex Elite

|

approx. 6,000 kr/year | 20 | 6 per 100 kr | Two 2-for-1s + Travel Insurance | High spenders / Status chasers |

Why the Amex 2-for-1 is a Game-Changer

Once you hit a yearly spending goal, you get a voucher that lets two people fly for the points of one on an award ticket. On a Business Class flight to New York, this can easily save you 100,000 points—whether you fly SAS or a SkyTeam partner like KLM, Air France, or Delta when award space aligns. Learn more in our SAS Amex 2-for-1 Voucher Guide 👇

2. SAS Mastercard: The Universal Companion (All Countries)

Accepted everywhere, the SAS Mastercard (issued by SEB in the Nordics) ensures you never miss a point. It’s the perfect backup to an Amex or a powerful primary card, especially in Denmark where it offers the Fly Premium benefit.

| Card | Annual Fee | Points per 100 kr | Key Benefit | Best For |

|---|---|---|---|---|

SAS Mastercard World

|

approx. 455 kr/year | 10–20 | Universal acceptance, Point-of-the-month bonuses | Backup card / Entry-level |

SAS Mastercard Premium

|

approx. 2,335 kr/year | 15–25 | Earns Status Points, Fly Premium Benefit | Frequent travelers seeking EuroBonus Gold/Diamond progress via Status Points |

The Fly Premium Benefit Explained

The Premium Mastercard lets you book a higher cabin (SAS Plus or SAS Business) for the points price of a lower one (SAS Go). It’s perfect when you can’t use a 2-for-1 voucher but still want premium comfort for fewer points.

Heads-up: Fly Premium applies to SAS-operated flights only, but your everyday spend still helps fund partner trips on KLM/AF/Delta when SAS space is tight. Learn more in our SAS Fly Premium Guide 👇

3. SAS Lunar: The Simple Debit Option (All Countries)

For those who prefer debit over credit, the Lunar card is a straightforward alternative. It’s linked to a digital bank account, requires no credit check, and makes earning points simple.

| Card | Monthly Fee | Points per 100 kr | Key Benefit | Best For |

|---|---|---|---|---|

SAS Lunar Debit

|

approx. 49 kr/month | 8 | No credit check, digital banking | Credit-averse users |

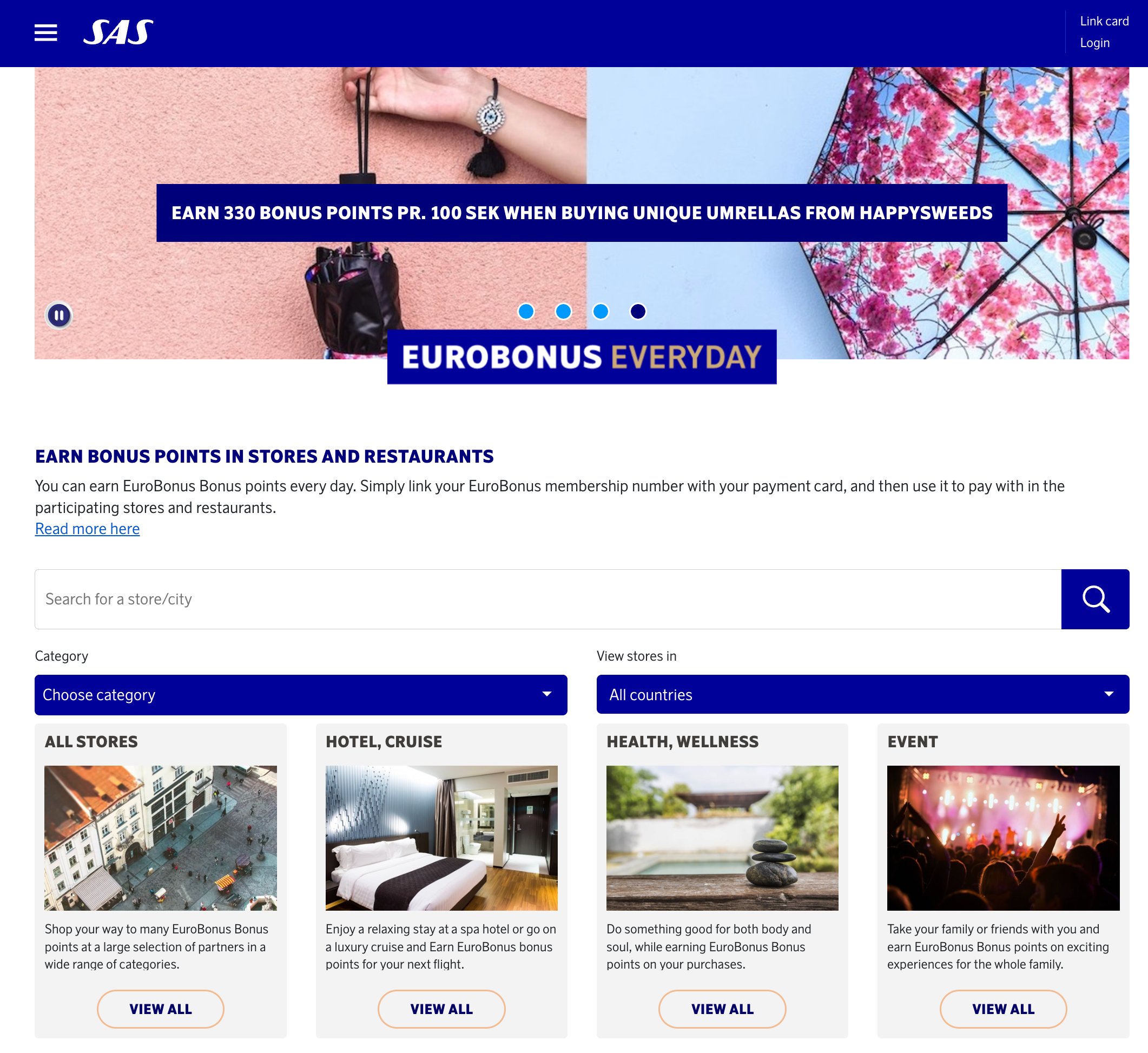

4. EuroBonus Everyday: Earn on Every Purchase

Beyond dedicated SAS cards, there’s a fourth, powerful way to earn: EuroBonus Everyday. This program lets you link your existing regular payment cards (Visa, Mastercard, or Amex from any bank) to your EuroBonus account.

Once linked, you automatically earn points when you shop at participating stores, restaurants, and online partners, with earning rates from 20 up to 250 points per 100 kr spent.

How It Works: A 3-Step Process

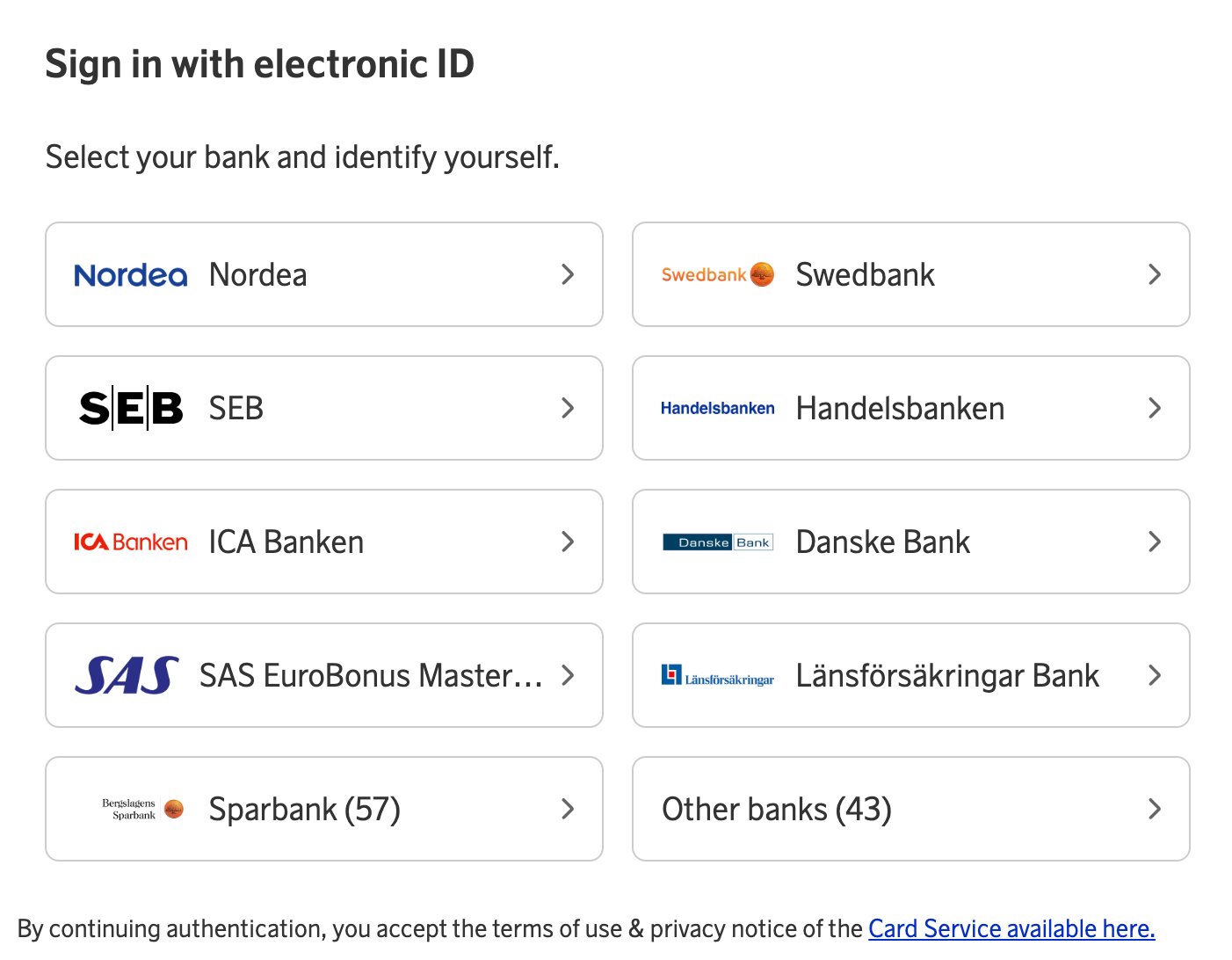

- Connect Any Payment Card: Link your preferred Visa, Mastercard, or Amex in the EuroBonus Everyday portal. This takes less than a minute. Crucially, you must also link your SAS-branded Amex or Mastercard here to earn these extra points.

- Shop & Eat at Partners: Find participating partners through the SAS App or the EuroBonus website. When you’re ready to pay, simply use your linked card as you normally would.

- Earn Points Automatically: Your points are automatically registered at the time of purchase and added to your EuroBonus account, converting your everyday spending into future award trips.

Pro Tip: The Double-Dip Strategy

If you pay with a linked SAS EuroBonus Amex or Mastercard, you earn points in two ways on the same purchase:

- The standard points from your card spend (e.g., 15-25 points per 100 kr).

- The bonus points from the EuroBonus Everyday partner (e.g., 100 points per 100 kr).

This “double-dip” is the single fastest way to accelerate your points balance.

Eligibility & How to Apply

Before applying, make sure you qualify:

- Residency & age: Cards are issued per country (SE/NO/DK) to residents aged 18+.

- Credit vs debit: Amex/Mastercard are credit products (require credit check and income). Lunar is debit (no revolving credit).

- EuroBonus number: Required during application so points post correctly.

How to apply (2 minutes):

- Pick your card on the issuer site (Amex Nordics for Amex; SEB for SAS Mastercard; Lunar for debit).

- Complete ID, income, and address verification.

- Add your EuroBonus number.

- On approval, activate and verify it’s linked in your card/app.

Earning Math & Break-Even ROI

| Annual Card Spend | Base Points Earned | Approx. Value | Typical Bonus | Net Takeaway |

|---|---|---|---|---|

| 100,000 kr/year | ~10,000 pts | ~1,000 kr | — | Entry tier: low fee cards can already be net-positive. |

| 150,000 kr/year | ~22,500 pts | ~2,250 kr | 1× 2-for-1 voucher (Amex Premium) | Inflection point: voucher unlocks premium-cabin value. |

| 300,000 kr/year | ~60,000 pts | ~6,000 kr | 2× 2-for-1 (Amex Elite) or Fly Premium (MC Premium) | Power band: premium cabins + status acceleration. |

| 450,000 kr | ~90,000 pts | ~9,000 kr | 3× 2-for-1 (Elite + Premium combo) | Advanced: multiple vouchers justify higher annual fees. |

| Notes: Point totals assume 15 pts/100 kr average across mixed spend. Real value varies by redemption (e.g., premium cabins with 2-for-1 or Fly Premium can exceed 0.10 kr/pt). | ||||

Optimization Tip

If you’re within ~10–15k kr of a voucher threshold, consider bill-pay services (Betalo/Bill Kill/Billo). Only do it when fees stay below your target value per point.

We assume a conservative value of ~0.10 kr per point. With 2-for-1 or Fly Premium on premium cabins, real value can be much higher.

- 100,000 kr spend: ~10,000 pts (~1,000 kr value). Low-fee cards already net positive.

- 150,000 kr spend: ~22,500 pts (~2,250 kr) + one 2-for-1 voucher worth 100,000+ pts on long-haul business trips.

- 300,000 kr spend: ~60,000 pts (~6,000 kr) + two 2-for-1 vouchers (Amex Elite). Pair with Mastercard Premium for extra Status Points and Fly Premium value.

Reality Check

Value depends on redemption style. Economy flights = lower value; long-haul business redemptions with vouchers = 5× to 10× return.

Which SAS EuroBonus Card Is Best For You? (Sweden, Norway & Denmark Comparison)

The right card depends on two things: where you live and how much you spend annually.

For Residents of Sweden & Norway

With Amex available, the dual-card strategy reigns supreme.

Casual Spender (Under 100,000 kr/year)

Strategic Earner (150,000–300,000 kr/year)

High Spender / Status Chaser (Over 300,000 kr/year)

For Residents of Denmark

Without Amex, the Mastercard Premium shines brightest.

Casual Spender (Under 150,000 kr/year)

Serious Traveler (Over 150,000 kr/year)

If you’re still undecided, SAS also provides an official ‘Card Matcher’ tool on their website for Sweden and Norway to help guide your choice.

The Winning Strategy: Using Two Cards for Maximum Points

For Sweden and Norway, the dual-card strategy is the fastest route to premium travel.

- Primary Card: SAS Amex Premium — use it wherever accepted to reach 150,000 kr spend for the 2-for-1.

- Secondary Card: SAS Mastercard World — use it for merchants not accepting Amex or for travel abroad.

Tip: Always pay balances in full monthly. Interest wipes out all point value.

Can You Share or Transfer EuroBonus Points?

The Short Answer: Limited options exist, but strategic workarounds help.

What You CAN Do:

- Household Bookings: Use your points to book tickets for family members

- Couples Strategy: Each person gets their own card to maximize earning

- Child Accounts: Kids 2+ can have their own EuroBonus accounts

- Family pooling: Pool points from multiple family accounts (not for status).

Advanced Strategy: The Multi-Amex Card Approach for Maximum Benefits

This advanced strategy is for high-spenders who want to maximize their 2-for-1 voucher potential. American Express allows you to have multiple Amex cards in Sweden and Norway. Here are the two most powerful multi-card strategies used by advanced points collectors.

The Cards:

- SAS Amex Elite

- SAS Amex Premium

The Math:

- SAS Amex Elite: Two vouchers at 150,000 kr and 300,000 kr spend

- SAS Amex Premium: One voucher at 150,000 kr spend

- Total: Three vouchers for 450,000 kr total spend across both cards

Important Voucher Distinction

Critical 2025 Update: Not All Vouchers Are Equal

The vouchers from Elite and Premium cards now have different redemption rules:

- Elite Vouchers (2x): Valid for all cabin classes including Business and First Class

- Premium Voucher (1x): Restricted to Economy and Premium Economy only

This means the three-voucher strategy now delivers two premium cabin vouchers plus one economy voucher - perfect for two luxury trips and one budget-friendly getaway.

The Downsides to Consider

- Annual Fees Stack Up: SAS Amex Elite (6,000 kr) + SAS Amex Premium (1,620 kr) = 7,620 kr/year in fees

- No Welcome Bonuses: You typically won’t qualify for new member welcome bonuses on additional Amex cards

- Spending Management: You need to track spending thresholds across multiple cards

- Credit Impact: Multiple applications may affect your credit score

Is This Strategy Right For You?

Consider the multi-card approach if:

- You spend over 300,000 kr annually on cards

- You regularly redeem points for premium cabin international travel

- The value of extra vouchers outweighs the additional annual fees

- You’re organized enough to manage multiple cards and spending thresholds

Stick with a single card if:

- Your annual spending is under 200,000 kr

- You primarily redeem for economy class flights

- You prefer simplicity over maximizing every possible benefit

- The additional fees don’t justify the extra voucher value

When the Math Works

Pro Calculation: If three 2-for-1 vouchers save you 200,000+ points on premium cabin redemptions (worth ~20,000+ kr), the 7,620 kr in combined annual fees can be easily justified for high-spending frequent travelers.

Pro Moves to Boost Spend (and Earn More Points)

Use these only if fees < expected point value or you’re close to a 2-for-1/Fly Premium threshold.

- Betalo (SE/NO): Pay invoices/bills by card (rent, taxes, contractors).

Watch-outs: Fees can reduce net gain, calculate before using. - Bill Kill (NO/SE): Convert bank transfers to card transactions.

Watch-outs: Fees/caps vary. - Billo (DK): Pay bills by card.

Watch-outs: Fees and limits change periodically.

Rule of thumb

If fees exceed 0.10 kr per point, skip it. But small fees can be worth it if they trigger a high-value voucher.

Common Pitfalls to Avoid

- Missing your 2-for-1 deadline: Spend thresholds reset annually: track via the Amex app.

- Assuming Amex works everywhere: Always carry a Mastercard backup.

- Not linking EuroBonus: Ensure your number is added during application.

- Letting points expire: Points expire after 5 years, redeem strategically.

- Ignoring foreign transaction fees: Mastercard often wins for international use.

Frequently Asked Questions

Your Questions Answered

Is the SAS Amex Elite worth the fee?

If you’re aiming for EuroBonus Gold/Diamond and redeeming long-haul premium cabins, the Elite’s 6 Status Points per 100 kr plus two 2-for-1 vouchers can justify the fee; otherwise, Amex Premium often delivers better ROI.

I live in Denmark. Am I missing out without Amex?

Not really. The SAS Mastercard Premium’s Fly Premium and Status Points easily rival Amex value if you fly SAS often.

When should I choose the Lunar debit card?

If you prefer debit, want no credit checks, or have lower annual spend. For maximizing points, credit cards still win.

What is a EuroBonus point actually worth?

Around 0.10 kr/point for standard redemptions—but up to 0.50 kr/point when used with a 2-for-1 or Fly Premium in premium cabins.

How quickly do points post?

Usually within a few days after the statement closes. If not after 30 days, contact your card issuer.

How can I find award seats?

Use AwardFares to search SAS and partners. Set alerts to book the moment seats appear. We surface availability across SAS and key SkyTeam partners (e.g., KLM, Air France, Delta) so you can pivot when one carrier has no space.

What are the current welcome bonuses?

-

SAS Amex Premium: 5,000 pts (split at 7 & 13 months)

-

SAS Amex Elite: 15,000 pts (split at 7 & 13 months)

-

SAS Mastercard World: 3,000 pts after 3 purchases in 30 days (no SAS MC in last 2 years; points within 3 months; card must be active at posting)

-

SAS Mastercard Premium: 10,000 pts after 3 purchases in 30 days (no SAS MC Premium in last 2 years; points within 3 months; card must be active at posting)

-

SAS Lunar Debit: 3,000 pts (new Lunar customers after 2024-06-17; card received within 14 days; spend 15,000 kr within 3 months)

Terms change—always confirm on the issuer page before applying.

Can I hold multiple SAS Amex cards at the same time?

Yes, American Express allows you to hold multiple cards in Sweden and Norway. This advanced strategy lets high-spenders earn multiple 2-for-1 vouchers, though you’ll pay multiple annual fees.

What's the difference between Elite and Premium vouchers in 2025?

Elite vouchers work for all cabin classes including Business, while Premium vouchers are restricted to Economy and Premium Economy only.

Do SAS cards charge foreign transaction fees?

Most SAS cards have no foreign fees for SEK transactions, but confirm with your issuer for international purchases.

Is it worth paying 7,620 kr/year for multiple cards?

Only if you spend 450,000+ kr annually and regularly redeem for premium cabin flights where the extra vouchers save you 20,000+ kr in point value.

Methodology & Sources

All fees, earning rates, voucher rules, and availability were verified on issuer pages (SAS, American Express, SEB/Mastercard, Lunar) in October 2025. Terms change, always confirm on the issuer site before applying.

Your Next Steps

You now have a clear framework to make your choice.

- Sweden/Norway: Amex Premium + Mastercard World = top combo.

- Denmark: Mastercard Premium = best all-rounder.

- Debit users: Lunar = simplest way to start earning.

Read More

Our guides have all the information you need to become a pro at exploring the world on points. Here are some related posts you might enjoy.

Our Commitment to Accuracy

To maintain this guide as the most reliable resource available, we continuously monitor the official issuer pages for any changes to fees, benefits, and terms. All card details, earning rates, and fees in this guide were last verified against official sources on October 21, 2025. We use the following primary sources:

- SAS: Official EuroBonus Credit Cards Page

- American Express: Official SAS Amex Cards Page

- Mastercard (SEB): Official SAS EuroBonus Mastercard Page (issuer: SEB Kort).

- Lunar: Official SAS Lunar Card Page

Aeromexico Rewards

Aeromexico Rewards Air Canada Aeroplan

Air Canada Aeroplan

Air France / KLM Flying Blue

Air France / KLM Flying Blue Alaska MileagePlan

Alaska MileagePlan American Airlines AAdvantage

American Airlines AAdvantage Azul Fidelidade

Azul Fidelidade Delta SkyMiles

Delta SkyMiles Etihad Guest

Etihad Guest GOL Smiles

GOL Smiles Jetblue TrueBlue

Jetblue TrueBlue SAS EuroBonus

SAS EuroBonus Turkish Miles&Smiles

Turkish Miles&Smiles United MileagePlus

United MileagePlus Virgin Atlantic Flying Club

Virgin Atlantic Flying Club Virgin Australia Velocity

Virgin Australia Velocity